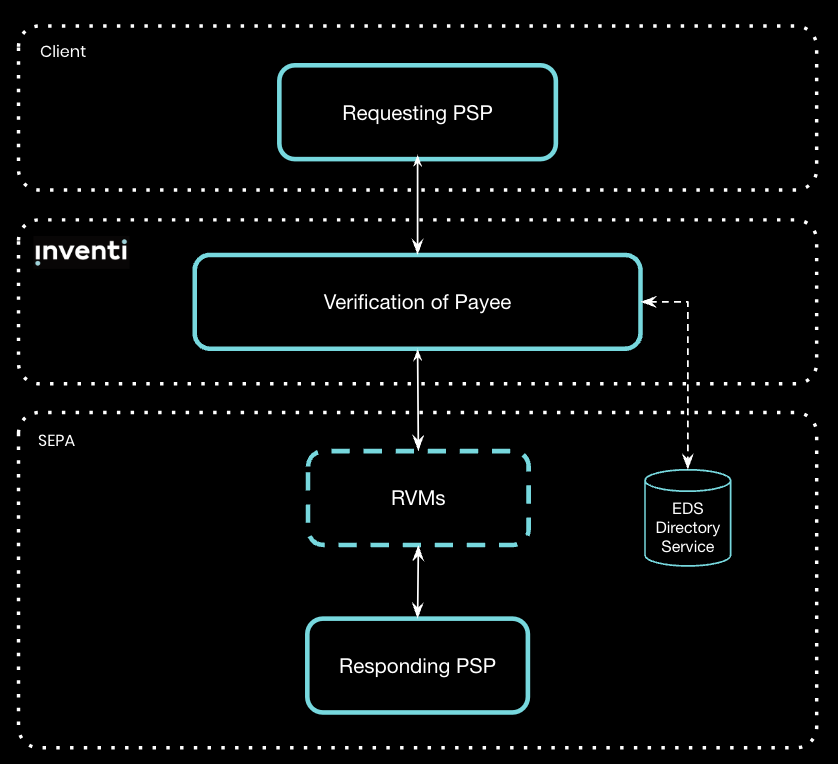

EU Regulation: Starting October 9, 2025, Payment Service Providers (PSPs) must implement Verification of Payee (VoP) to match the payee’s name with the IBAN before processing payments (Article 5c).

Benefits of Verification of Payee (VoP):

- Reduces Misdirected Payments

- Prevent Authorized Pushed Payment (APP) fraud

- Enhances trust in the security and accuracy of payments across Europe

- Promotes a Standardized Verification Framework

- Reduces disputes and increases reliability for both individuals and businesses