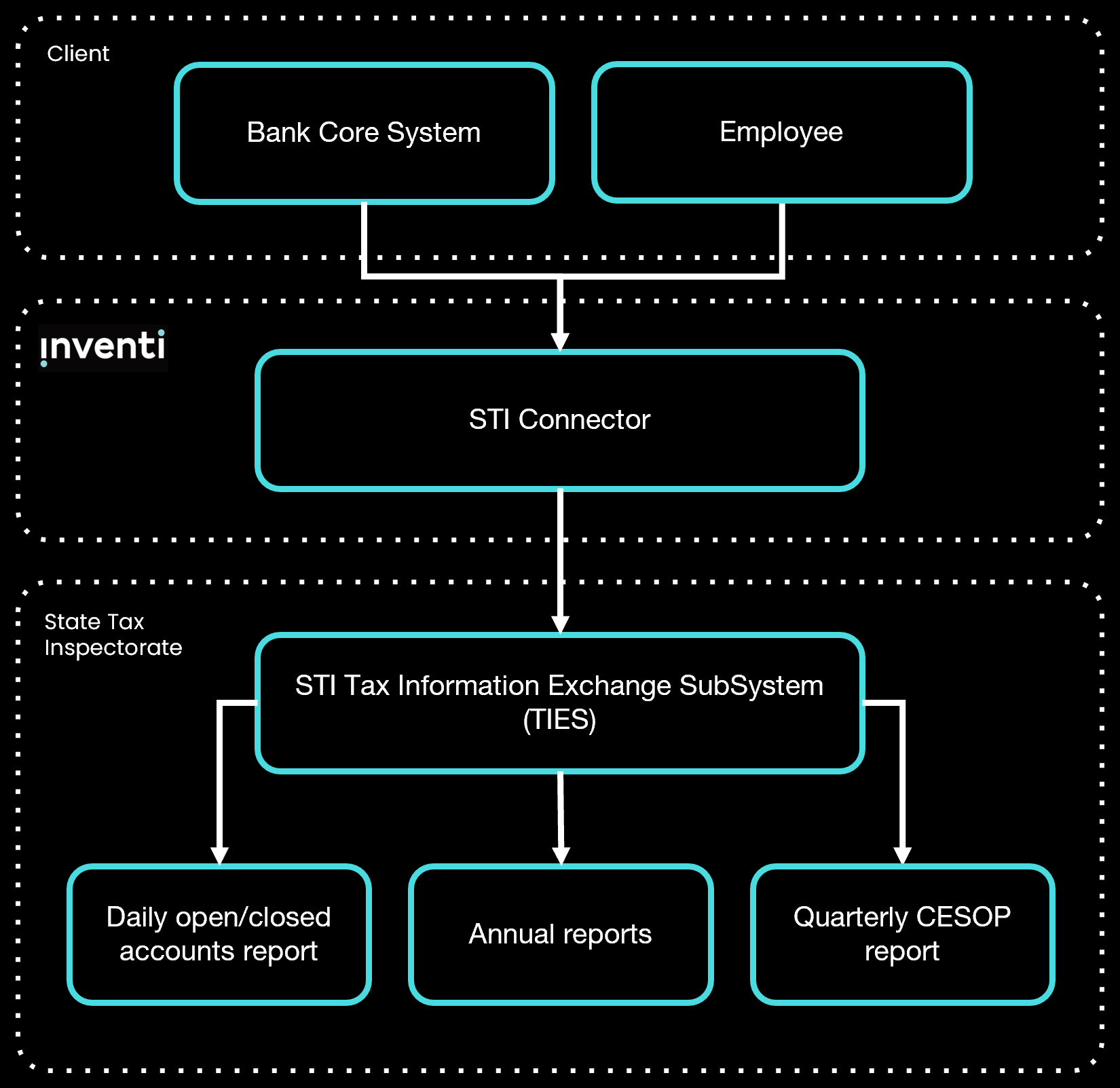

Inventi STI Connector integrates any client core banking technology with the TIES system owned by State Tax Inspectorate (STI) of the Republic of Lithuania (liet. Valstybinė mokesčių inspekcija, VMI). This enables STI Connector clients to easily and accurately report information to STI that is mandatory for regulatory compliance.

The STI Connector is designed to simplify the reporting process, providing clients with the ability to integrate directly using an API or submit the data manually using Excel. It provides a dedicated GUI where users can trigger report submission, review status and manage errors.

The entire system is continuously maintained by Inventi to ensure hassle-free integration with STI TIES system and guarantee client compliance.