Fraud prevention system by inventi is a next-generation platform for digital banking fraud prevention.

The system triggers alerts on the occurrence of certain events (rules) or array of events (scenarios).

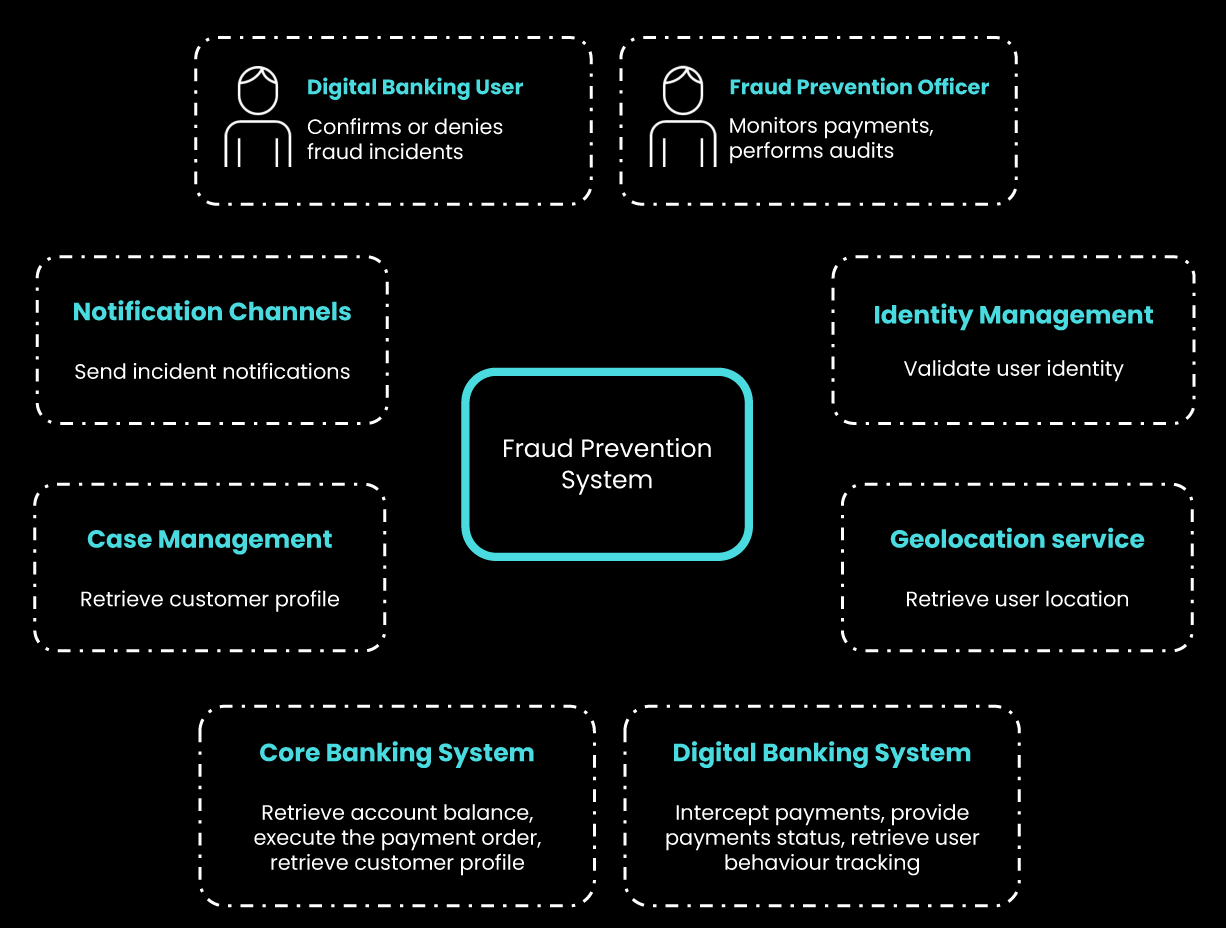

FPS is a stand-alone addendum to the internal systems of the financial institution, using the data of daily operations, in combination with other possible internal and external data sources (KYC, lists of sanctioned entities and many more).